In the fast-paced world of financial trading, finding the best UK CFD trading platform for Forex CFDs can be a game-changer. Contract for Difference (CFD) trading has gained immense popularity among investors and traders for its flexibility and potential profitability. However, not all CFD trading platforms are created equal. In this comprehensive guide, we will explore what makes the best UK CFD trading platform and how it can enhance your Forex CFD trading experience.

Understanding Cfd Trading

Before diving into the specifics of the best UK CFD trading platforms, let’s first understand what CFD trading entails. CFDs are financial derivatives that allow traders to speculate on the price movements of various assets, including currencies, commodities, stocks, and indices, without actually owning the underlying asset. Instead, traders enter into contracts with their chosen broker to profit from the difference between the asset’s opening and closing prices.

One of the primary attractions of CFD trading is leverage, which enables traders to control larger positions with a relatively small amount of capital. This amplifies both potential gains and losses, making risk management a crucial aspect of CFD trading.

Choosing The Best UK CFD Trading Platform

Selecting the best UK CFD trading platform for Forex CFDs requires careful consideration of several key factors. Your choice can significantly impact your trading success, so it’s essential to make an informed decision. Here are the essential features and considerations to keep in mind:

- Regulatory Compliance: The first and most crucial factor to consider is regulatory compliance. Ensure that the CFD trading platform is regulated by the UK Financial Conduct Authority (FCA). Regulation provides a level of security and accountability for traders.

- Asset Coverage: Evaluate the platform’s asset coverage, particularly in terms of Forex CFDs. The best platforms offer a wide range of currency pairs, allowing you to diversify your trading portfolio and take advantage of various market opportunities.

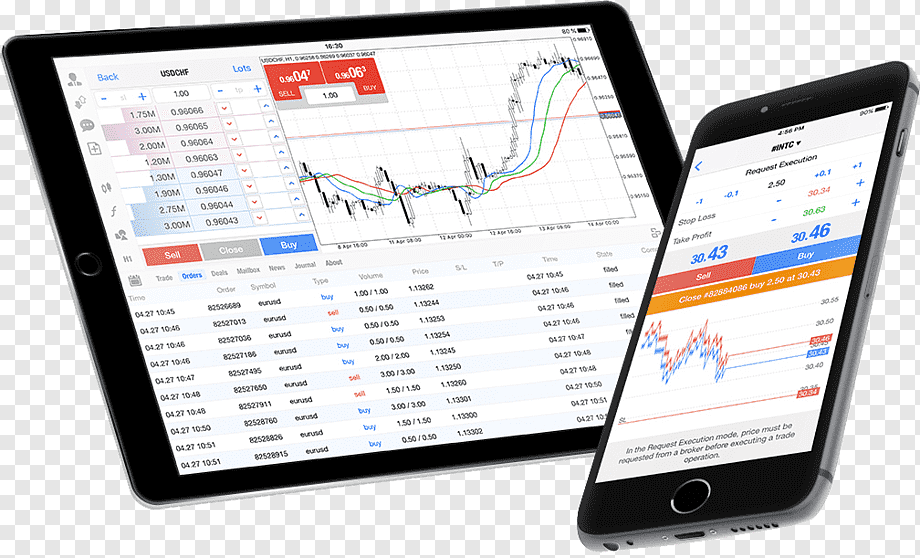

- Trading Tools and Analysis: Look for platforms that provide advanced trading tools and in-depth market analysis. These tools can help you make informed trading decisions and execute strategies effectively.

- User-Friendly Interface: A user-friendly and intuitive interface is essential, especially if you’re a beginner. Navigating the platform should be straightforward, and executing trades should be hassle-free.

- Customer Support: Reliable customer support is vital. Check if the platform offers various support channels, such as live chat, email, and phone support, to address any issues or concerns promptly.

- Competitive Spreads and Fees: Compare the spreads and fees charged by different CFD trading platforms. Lower spreads can significantly impact your trading profitability over the long term.

- Risk Management Tools: The best CFD trading platforms offer risk management tools like stop-loss and take-profit orders. These features help you limit potential losses and lock in profits.

- Mobile Accessibility: In today’s fast-paced world, mobile trading is a must. Ensure that the platform has a mobile app or a responsive web interface for trading on the go.

- Educational Resources: Look for platforms that provide educational resources, including tutorials, webinars, and market analysis. These resources can help you improve your trading skills.

- Demo Accounts: Before committing real capital, test the platform with a demo account. This allows you to familiarize yourself with the platform’s features and practice your trading strategies without risking real money.

Best Uk Cfd Trading Platforms

Now that we’ve outlined the essential factors to consider, let’s explore some of the best UK CFD trading platforms for trading Forex CFDs:

- eToro: Known for its social trading features, eToro is an excellent choice for both beginners and experienced traders. It offers a wide range of Forex CFDs, a user-friendly interface, and a social trading network that allows you to follow and copy the trades of experienced investors.

- Plus500: Plus500 is a user-friendly CFD platform that offers a comprehensive selection of Forex pairs. It is known for its tight spreads and straightforward trading interface. Plus500 is regulated by the FCA and provides risk management tools.

- IG Group: IG Group is a well-established CFD broker with a strong reputation. It offers an extensive range of Forex CFDs, advanced trading tools, and in-depth market analysis. IG Group is regulated by the FCA and provides excellent customer support.

- Pepperstone: Pepperstone is a popular choice among Forex traders, offering competitive spreads and a range of currency pairs. It provides the MetaTrader 4 and MetaTrader 5 platforms, known for their advanced charting and analysis tools.

- AvaTrade: AvaTrade is a user-friendly CFD broker with a strong focus on customer support and education. It offers a wide variety of Forex pairs and provides traders with access to the popular MetaTrader platforms.

- CMC Markets: CMC Markets is a well-regulated CFD broker offering a comprehensive range of Forex CFDs. It stands out for its powerful trading platform and extensive research and analysis tools.

- Saxo Bank: Saxo Bank is a reputable CFD broker known for its high-quality trading platforms and a vast selection of Forex pairs. While it caters to more experienced traders, it offers valuable tools and resources for all levels.

Conclusion

In the realm of Trade Forex Cfd trading in the UK, choosing the best CFD trading platform is a critical decision that can significantly impact your trading success. The best UK CFD trading platform for Forex CFDs should be regulated, offer a wide range of assets, provide advanced trading tools, and prioritize user-friendliness.

As you embark on your CFD trading journey, carefully evaluate the platforms mentioned above and consider your individual trading needs and preferences. Remember that trading CFDs involves risk, and it’s essential to educate yourself, use risk management tools, and trade responsibly. By selecting the right platform and implementing sound trading strategies, you can harness the potential of Forex CFDs and work towards your financial goals.