In our interconnected world, the need to send money across borders has become increasingly common. For many individuals residing in the vibrant United Arab Emirates (UAE) and wanting to support their loved ones in India, the process of sending money is not just a transaction but a crucial connection. In this comprehensive guide, we will explore the various methods and considerations involved in sending money to India from the UAE.

Understanding the Landscape

Sending money internationally requires a thoughtful approach, considering factors such as fees, processing time, and exchange rates. As a sender, it’s crucial to be informed about the available options and choose a method that aligns with your priorities.

1. Traditional Routes: The Banking Experience

Banks have long been the traditional choice for international money transfers. While they offer a sense of security, it’s essential to be aware of potential drawbacks. Processing times can be lengthy, and the fees and exchange rates may not always be favorable. Before opting for this method, consider the specific terms and conditions of your bank.

2. Embracing Technology: Online Money Transfer Platforms

In the digital age, online money transfer platforms have emerged as convenient alternatives to traditional banking. Platforms like Xoom, Remitly, and Wise empower users to send money swiftly, often at competitive rates. The ease of use and quick processing times make these platforms attractive to those seeking efficiency in their financial transactions.

The Journey of a Transaction: Step by Step

When sending money from the UAE to India, the journey involves a series of steps, regardless of the chosen method. Let’s break down the process to help you understand what to expect:

Selecting a Reliable Provider:

Before initiating a transfer, research and choose a reputable service provider. Look for factors such as user reviews, transaction fees, and exchange rates to make an informed decision.

Registration and Verification:

Most platforms and banks require users to create accounts and complete a verification process. This step ensures the security of the transaction and compliance with financial regulations.

Inputting Recipient Details:

Provide accurate information about the recipient, including their name, address, and bank details. Double-check this information to avoid any complications during the transfer process.

Choosing the Transfer Amount and Currency:

Specify the amount you wish to send and select the currency. Be mindful of potential fees and exchange rate fluctuations that may affect the final amount received by the recipient.

Reviewing and Confirming:

Take a moment to review all the details before confirming the transaction. This step ensures accuracy and minimizes the risk of errors.

Conclusion: A Trusted Partner for Your Financial Connections

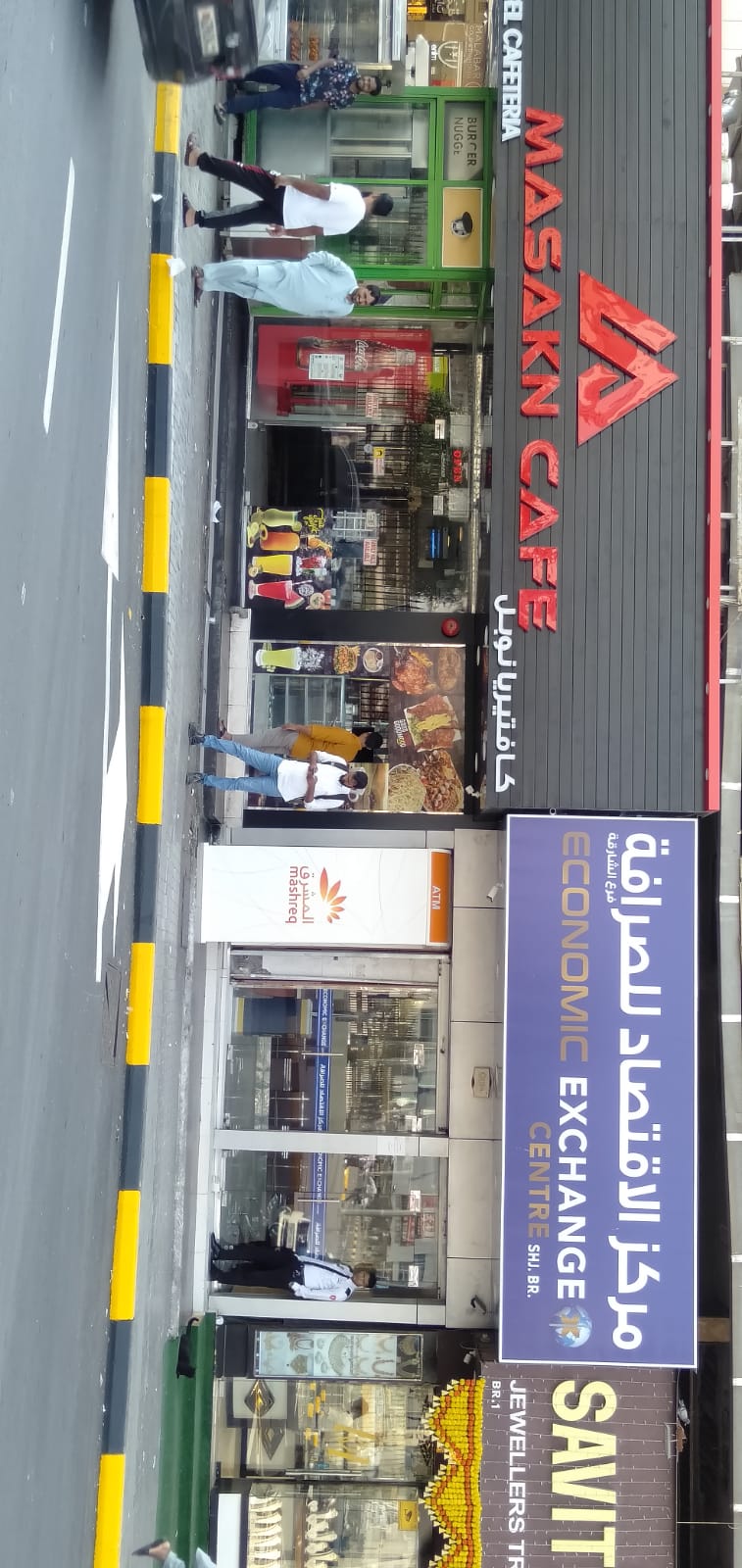

As we conclude this guide on sending money to India from the UAE, we’d like to introduce you to a convenient option for your international transactions: Economic Exchange Centre…